🌟 Kinsale Capital Group (KNSL): Still a Compounder or Time to Worry?

Kinsale Capital Group (KNSL) has been a star among specialty insurers for years. Focused exclusively on high-risk Excess & Surplus (E&S) insurance, Kinsale built a tech-driven underwriting machine with ~40% annual revenue growth since its 2016 IPO.

But recent earnings raised important questions:

Is KNSL's hypergrowth story slowing?

Should long-term investors be concerned?

Is the recent price drop an opportunity or a warning?

Let's dive in. 📃👇

📊 Latest Earnings Snapshot

🔹 Net Operating Earnings (Q1 2025): $86.4M (+5.9% YoY)

🔹 Gross Written Premiums: +7.9% YoY (down from ~20% previously)

🔹 Combined Ratio: 82.1% (up from 79.5%)

🔹 Investment Income: +33% YoY

🔹 Catastrophe Losses: Higher due to the Palisades Fire

Stock Price Reaction:

Dropped sharply post-earnings, now around $420 (vs. highs over $500).

📈 Why the Market Reacted Negatively

🔻 1. Premium Growth Slowed for Two Straight Quarters

Q4 2024: +12.2%

Q1 2025: +7.9%

🔻 2. Margins Compressed

Combined ratio increased to 82.1%.

Net margin dropped sharply in Q1 2025.

🔻 3. Higher Catastrophe Losses

Increased claim payouts hurt underwriting profitability.

🧐 Long-Term Perspective: Should We Worry?

✅ KNSL is still growing premiums and profits.

✅ Combined ratio remains below 85% (still solid).

✅ Investment income growth supports earnings.

🔺 BUT:

Slowing premium growth must stabilize.

Underwriting margins must hold.

The next few quarters are critical.

📈 Growth and Profitability Charts: Context Matters

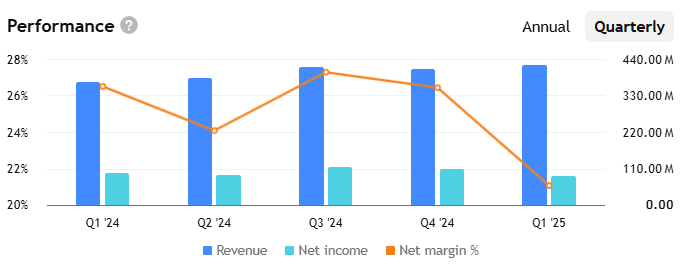

🕰️ Quarterly View (Q1 2024 – Q1 2025)

Revenue continues growing steadily.

Net income was stable, but dropped sharply in Q1 2025.

Net margin compressed in Q1 2025 — mainly due to catastrophe losses

🕰️ Annual View (2020 – 2024)

Revenue and net income grew significantly.

Net margins are trending higher long-term.

2022 slowdown visible, followed by 2023 reacceleration.

Short-term volatility. Long-term resilience. Watch execution closely.

📚 Lessons From 2022: They Have Overcome This Before

In 2022, Kinsale faced a similar situation:

Premium growth slowed.

Net margin compressed noticeably.

What happened next?

Management adjusted pricing and underwriting.

Growth and profitability reaccelerated strongly in 2023.

"Great businesses adapt during tougher times, and Kinsale already proved it once."

📊 Valuation Analysis: Is KNSL Cheap Yet?

1. Discounted Cash Flow (DCF)

Bull Case (15–17% growth): ~$520–540

Base Case (10–12% growth): ~$450–470

Bear Case (5–8% growth): ~$370–390

2. Reverse DCF

Current price implies ~10–12% growth expectation.

3. Historical Multiples

KNSL historically trades at 6–7x sales.

Now at ~5.5x sales — valuation resetting, but still a premium.

🛑 Key Risks to Watch

🔺 Sustained premium growth slowdown (<10%).

🔺 Rising combined ratios (>83–85%).

🔺 Competitive pressure from standard insurers.

🔺 More frequent catastrophe losses.

🔺 Valuation multiple compression.

🔢 Action Plan: Buy, Hold, or Cut?

✅ Hold current position — fundamentals not broken yet.

✅ Don't add aggressively yet — monitor next earnings.

Where to Add More:

$400–416 = First support zone.

$370–380 = Strong buy zone (great margin of safety).

💪 Final Thought

Kinsale remains a quality business, but it’s at a critical point.

"True compounders are made during tough times, not easy ones."

If KNSL stabilizes and reaccelerates, this could be an amazing entry point looking back.

If not, careful monitoring will save us from a value trap.

We’ll keep tracking. 🚀